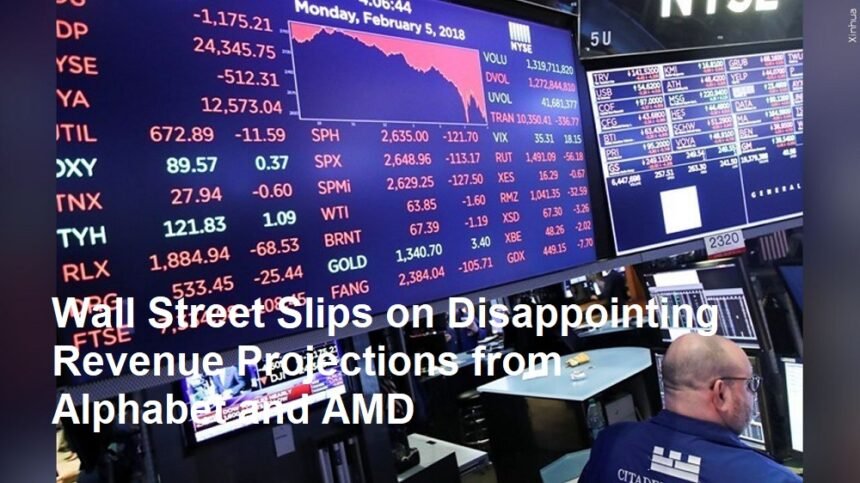

On Wednesday- February 5 2025, Wall Street experienced a significant downturn in trading as major technology stocks faltered following disappointing revenue projections from Alphabet Inc. and Advanced Micro Devices (AMD). The unexpected forecasts have rattled investors and analysts alike, triggering widespread concern over the tech sector’s growth prospects amid an increasingly volatile economic landscape.

The day began with an air of anticipation as investors awaited the quarterly earnings reports from key technology players. However, both Alphabet and AMD reported revenue figures that fell short of market expectations. Alphabet, the parent company of Google, issued a cautionary outlook citing challenges in its advertising business and rising operational costs. Meanwhile, AMD, known for its high-performance computing chips, attributed its weaker-than-expected revenue to supply chain disruptions and intensifying competition in the semiconductor market.

These disappointing projections sent shockwaves through the market, resulting in a broad sell-off in technology stocks and dragging down overall market indices. “The revenue forecasts from Alphabet and AMD indicate underlying headwinds in the tech industry, which has long been seen as a growth engine for the market,” said Mark Stevens, a senior market strategist at Global Capital Analytics. “Investors are now re-evaluating their expectations, and that has translated into a sharper than usual decline on Wall Street.”

The impact of the news was immediate. Shares of Alphabet dropped by nearly 5% in early trading, while AMD’s stock fell by over 6%. The sell-off spread to other technology companies, as investors grew increasingly worried about the sustainability of growth in the sector. Trading volumes surged, with market participants scrambling to adjust their portfolios in response to the negative earnings outlooks.

Analysts point to several factors that contributed to the disappointing revenue projections. In the case of Alphabet, a slowdown in digital advertising spending amid global economic uncertainty played a significant role. Despite efforts to diversify its revenue streams through cloud computing and hardware ventures, the company’s core advertising business remains a critical component of its earnings. The report indicated that increased competition from other digital platforms and regulatory pressures in key markets have also strained Alphabet’s revenue growth.

Similarly, AMD’s revenue shortfall was largely driven by ongoing supply chain challenges and the intensified competition in the semiconductor industry. The global chip shortage, while easing in some regions, continues to affect production timelines and cost structures. Furthermore, AMD’s rivals, including industry giant NVIDIA, have made significant inroads in the high-performance computing segment, putting additional pressure on AMD’s market share and pricing strategies.

Investors are now questioning whether these challenges represent a temporary setback or a longer-term shift in the technology landscape. “Both Alphabet and AMD are fundamentally strong companies with robust business models, but their recent revenue projections highlight the pressures that even the most dominant players face in today’s environment,” commented Dr. Emily Carter, an economist at TechInsights Research. “It’s a reminder that rapid technological innovation and global market uncertainties can have immediate and profound effects on earnings expectations.”

The market’s reaction also underscored broader concerns about the potential ripple effects of subdued growth in the technology sector. As tech stocks represent a significant portion of major indices, any sustained downturn could have implications for overall market sentiment and economic recovery prospects. Investors are now keeping a close watch on upcoming earnings reports and economic data releases, hoping for signs that these headwinds are either temporary or manageable.

In response to the negative projections, both Alphabet and AMD have reaffirmed their commitment to investing in future technologies and addressing operational challenges. However, the road ahead appears uncertain, with many analysts calling for caution and a re-assessment of valuation metrics in the tech sector.

As Wall Street continues to digest the impact of these earnings projections, the day’s trading serves as a stark reminder of the inherent volatility in technology markets. For now, investors remain on edge, closely monitoring further developments that could either alleviate or exacerbate the current downturn.